Introduction to Budgeting

Budgeting is for Everyone.

Find out How to Get Started.

Congratulations! You are thinking about creating your own personal or household budget.

People who start budgeting do so for one or more of these reasons:

- Landed your first substantial job

- Struggling to make ends meet

- Falling behind in your credit card or other payments

- Want to whittle down your personal debt

- Want to save for a large purchase like a home, car, or vacation

- Want to secure stable finances for your family’s welfare

- Want to decrease the stress and worry about money

Do any of these reasons sound like yours?

That’s great because these are all important reasons to get started. And there are several ways to do a budget; you are sure to find the one to help you.

Now, before you actually start your budget there are some things that are important to know about. We will talk about those first and then get into the steps to create a practical budget. Feel free to jump around this post. The Table of Contents will take you to any subject you desire. Then go back and read the whole post from start to finish to get a clear picture of the budgeting process.

Don’t be afraid or intimidated about learning to create a household budget. As with many ventures you just have to get started and soon you will be glad that you did!

Table of Contents

Set Some Financial Goals

The importance of setting financial goals can’t be overstated.

Not only will having long-term goals help you to save for important things like your kids’ college funds and your own retirement, but for even smaller life goals. Having long and short life goals can help you to manage your money more wisely and to make decisions that are in line with your intentions.

What do you want to save for?

Whether you want to save up for a new refrigerator or for a week-long tropical family vacation, setting money goals can help you to stay motived to spend less and save more.

If you need inspiration, check out these benefits for creating some tangible goals today.

Benefit 1 – Sets Your Focus

Having goals for your money helps to set your focus and intention. You can create a better plan when you know where you want to go. Having an outcome in mind tells you just how much you need to save each week and keeps your mind centered on that particular goal.

Benefit 2 – Creates Motivation

Creating a tangible financial goal is far more motivating than just having a general idea of what you’d like. For example, you might know you’d like to take your family on a trip somewhere warm next year. But that’s quite vague and easy to forget when you’re looking at making other more immediate choices for your money. Instead, develop a real and specific goal to shoot for by rallying the family to determine a location for your next getaway and deciding when to go. Knowing your goal is to take everyone to Hawaii for a week next June makes your goal much more real.

Benefit 3 – Changes Your Attitude About Money

When you have goals for your finances, your money suddenly becomes much more real. It has a destination and a purpose beyond merely getting through today or next week. You know what you’re working for. It’s not just for your family’s happiness; it’s for your family to have a specific experience like a vacation or to provide them with particular options such as a college education. Picturing a far-off retirement is very different from knowing just how much money you’ll need to live a comfortable life 20 years from now. Your goals give you direction, and they provide you with a clearer understanding of money.

Hopefully, these benefits will help you to remember just why setting money goals is important. Take some time to draft a few specific financial plans of your own and see what a difference it makes.

Thoughts About Budgeting

Can a Household Budget Help You?

A budget is essential if you want to maintain healthy finances, save for your goals, and save for difficult events. This simple tool lets you know if you can afford all of your expenses and extras or if you need to re-prioritize in order to make things work.

You can keep your budget in a hand-written ledger, on a complicated spreadsheet or through an app on your phone. What matters most is that you have one. Read on to learn more about budgets.

Let’s first take a look at the importance of budgeting and why you should spend the effort.

What Exactly Is a Budget?

A budget is basically just a plan. It’s a plan for how you intend to distribute the money that comes in to the expenses that must go out. A typical budget extends for the period of a month. Your spending plan will consist of a tally of how much income you make and a breakdown line by line of each expense you have for that time period. You may also wish to include a short description of each line item for clarification.

Why You May Want To Keep A Household Budget

We work hard to earn a living. We should make sure we spend the money we bring home wisely. That’s where a household budget comes in. It’s a good tool to see at a glance what we have coming in, what’s going out (and what that money is paying for) and if there’s anything left at the end of the month to put into savings.

Before we dive into exactly what a budget can do for us, let’s consider for a minute what will happen if we’re not tracking income and expenses. We may end up spending more than we’re making in a given month (or two, or three). Over time that can put us into some pretty hot water financially. We may also spend a lot more than we’d like to believe on things like eating out, going to the movies or new clothes.

Having a budget gives us more control over where we want to really spend our hard earned cash. Maybe that’s dinner and a movie, but maybe it isn’t. Wouldn’t it be nice to have an actual choice?

Primarily, it ensures you have enough money to meet your monthly expenses. Without a budget, it can be easy to overspend without realizing the impact that could have. A budget gives you an idea of how much money you have at any given time. It provides insight that can help you to meet your goals, whether that goal is to save for a particular item, to allocate a certain amount of money for paying off debt or something else entirely.

The Great Results of a Budget

Why Make a Budget? While common sense might tell you that budgeting is a good idea, you may need a few reasons to help you get motivated. Budgeting is one of those things that isn’t always fun at first, but you’ll enjoy it when you start to reap the rewards.

Budgeting will allow you to have more financial security. Do you get a pit in your stomach every time you see the stack of bills sitting in the mailbox? Are you always wondering how you’re going to make it to the next paycheck?

–Peace of mind is one of the greatest benefits of budgeting. Instead of wondering where your next dollar is going to come from, you can relax. When you’re living within your means and you put a little money aside each time you get paid, it doesn’t take long to be able to breathe easier.

–Having money in savings can not only give you peace of mind, but it can truly protect you if you get in a situation when money gets even tighter. For example, when a layoff comes to someone in your family, having money in savings will protect you from losing everything.

Making a budget also helps you to prepare ahead of time for expenditures. Instead of just spending without thinking, having a budget gives you a reference for making decisions about your finances.

–If you’re like most people, you just spend money if you have it instead of thoughtfully considering each purchase. Budgeting helps you to understand the difference between the things

you need and things you want.

–Unless you have unlimited funds (and that’s probably not the case since you’re reading this),creating and living by a budget makes sense. If you’re in a lot of debt, it really makes sense to stick to a budget and try to get out of it.

–It Tracks Where Your Money Is Going

A budget simply tracks your money. You record where the money comes from each month (your income) and then write out everything you spend it on, starting with your regular monthly bills like mortgage or rent, car payments, utility bills etc. What’s left after all the bills are paid is your discretional income.

–Helps You Identify Things You Waste Money On

Having it all in front of you in black and white helps you identify things you’re wasting your money on.

–It makes you reconsider if you really want to spend well over $200 a month on Cable TV or $150 on your large cell phone plan. Or how about that yearly magazine subscription to something you no longer read? Go through your expenses and reevaluate if this is REALLY how you want to spend your pay check.

–Allows You To Be Proactive About Savings

Saving money without a budget is hard. We go in with the best of intentions at the beginning of the month, but somehow there isn’t anything left at the end of the month.

–A budget gives you a chance to plan wisely. Set aside some money for savings at the beginning of the month, even if it’s just $20. Put it in the budget as a regular expense, just like you do with your other urgent bills. If you need to, open a separate savings account so you’re not tempted to spend it.

–Ensures You’re Not Spending More Than You’re Making

–Most importantly, your budget will keep you on track and help you make sure you’re not spending more than you’re making. And I don’t have to tell you that that’s pretty important for your financial wellbeing

The Debt Danger

Being in debt is one of the most difficult situations to escape from. Debt can make you feel enslaved to a corporation that doesn’t care about whether you have children to feed, a roof over your head, or a job.

It’s easy to get into debt – even if you’re making great money. In fact, people who make a lot of money are often in debt up to their eyeballs to keep up with other affluent friends.

But being in debt means you don’t really “own” anything and puts you in danger of major financial woes.Imagine making a six-figure salary and charging lavish items on credit cards. While you might be able to keep up with the payments as long as you have a job, what happens if you lose it?

You might be thinking that it won’t happen to you, but it can happen to anyone.

Before you know it you’re not able to pay credit cards, car notes, or even your mortgage. It might not have seemed unreasonable to get into the debt when your income was good, but when you lose your income it can be financially tragic.

When you don’t buy items you can’t afford, you’re protected from the danger of losing everything to debt. There’s strength and confidence in being able to pay cash for your purchases.

Ultimately, that will be your goal in creating a household budget.

Commom Budgeting Pitfalls

You may have tried to budget before but not have had success. That could be because you haven’t really gone about it the right way for you. Some of the common budgeting mistakes

people make are:

Not making a budget that’s realistic for your family

Making a budget, but not committing to it

Not communicating with your spouse and/or children about the budget

Disagreeing on what expenses are necessary

Misidentifying needs versus wants

Being inconsistent with financial habits

While budgeting can be challenging, it’s not impossible. When you have a budget, you need tobe realistic about your own family and have good communication. In this guide you’ll learn howto do that – it doesn’t always come naturally to people.

You’ll also need to be committed to following through with your budget. Setting some goals canhelp you to have motivation and to see your success. Don’t worry – we’ll cover all of that hereas you continue reading

Money Is Emotional

While talking about money seems to be pretty objective and about dollars and cents, in actuality it’s quite emotional. You may have many feelings surrounding your financial situation. Some of those are good and some can be very bad.

It’s important to separate your value as a human being from your financial value.

Everyone makes mistakes and has difficult challenges. If yours happen to be financial, you can sometimes feel desperate, humiliated, and embarrassed.

You’ll need to try to let go of those feelings so that you can look at things more objectively. It will feel really good to get in control of your funds. And if you’ve made financial mistakes or are experiencing hard times, you should feel proud that you’re ready to face things.

Getting on the Same Page with Your Spouse

Finances can be tough for couples to discuss and manage. If you’re in a relationship where you share the same household or if you’re planning to in the near future, you need to learn to communicate about money.

This can be a major challenge for any couple. Set some guidelines about being open when discussing money. You’ll also need to make sure not to make things personal.

You may have very different ideas on how to spend money – in fact you probably do.

Try not to make personal attacks when you disagree about money. If you find that you’re getting in a heated discussion, it might be best to take a break and cool off before continuing. Working through financial issues is tough, but necessary if you’re going to have good financial health.

You may want to look for some resources to help you communicate about money as a couple. A financial counselor can be beneficial if you need an objective ear.

You may also want to look at books designed to help couples get on the same page about money.

Including Kids in Your Budget Planning

The earlier your children begin learning about money, the better. The habits they set up now arethe ones they’ll carry throughout their lifetime. So it’s important to include them i to sit down with everything first on your own and even make a poster of how much is coming in and going out before you share the process with your kids.

But once you understand the big picture, you can talk to them about what you need to do.

Let your kids help you to eliminate expenditures that are unnecessary – no doubt some of those purchases are for them. When it comes to buying toys and extra things that they want, it’s a good idea to start an allowance so they can begin understanding how to earn money and budget

for themselves.

A good rule of thumb is for allowance to be one dollar for every year of a child’s life. You can distribute it weekly or every two weeks. It’s important that your child has to earn that money though, by doing some chores.

They don’t have to be major chores and they should be age appropriate. Then help them to setup a container for savings and spending. You may even want to have a jar for donations to teach children about sharing what they have at an early age.

As children, they can save more than you probably can as an adult. You might want to start with saving 20% of their income. Make sure to help them figure out how much that is and let them place it into the containers.

Then when they want to purchase something, you can help them figure out how long it will take to earn the money. Once they have a good amount in their savings jar, you can take them to open up a bank account so they can become familiar with the banking system.

Discussing finances openly with your children will also help them to understand why they can’t always have what they want. Instead of saying, “We’re too poor for that,” you can explain that the purchase isn’t in the family budget.

Having the family budget out where everyone can see it can help kids to be part of the financial team. If you want to take a family vacation, it can be written on the poster and the kids can be taught that they have to give up some wants in order to save for something even better.

Many people try to keep financial information away from their children for fear that they will then worry. But children need to learn about finances early so that when they become adults it’s not a shock to manage their own money.

You’ll really be setting your child up for future financial success. Many people make financial mistakes because they aren’t educated about money or they have spending habits that began as a child. People have emotions surrounding money that began in their childhood and continue on into adulthood. Educating your children now is a great gift for them.

How to Create a Household Budget

Many people say, “I need to get on a budget!” But when it comes down to it, they don’t know how to do it. It can be really hard to change the way you spend money. It’s as difficult (and sometimes more difficult) than changing your diet.

But the benefits of budgeting far outweigh the difficulties. And if you know what you’re doing, it’s really not too hard to make a budget and stick to it. Many people make the mistake of giving up before they’ve really gotten started.

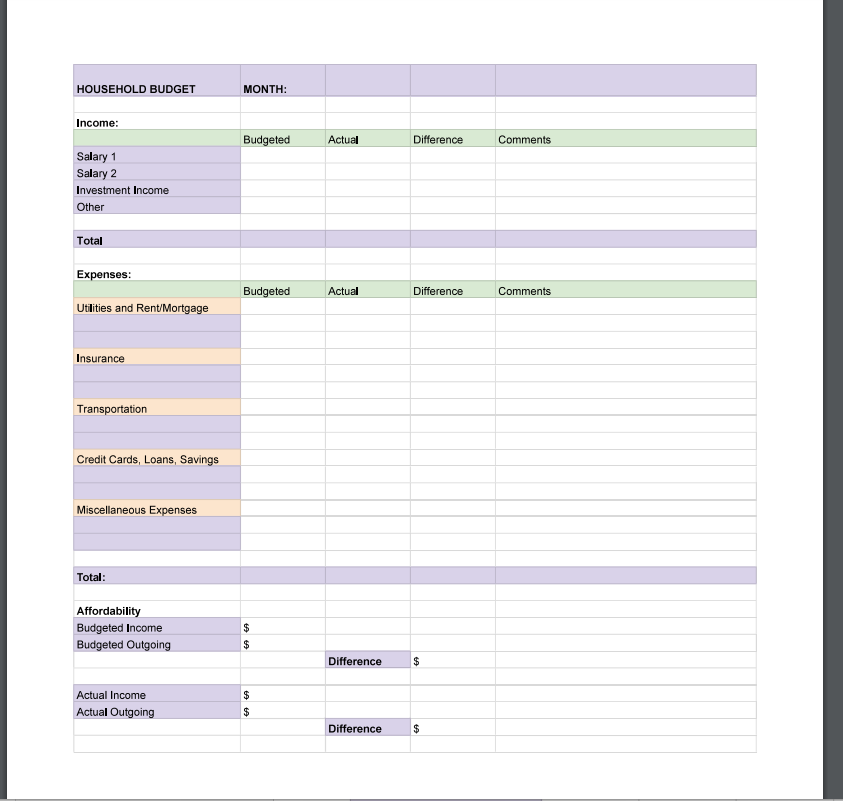

In this guide you’ll learn how to create a household budget that will work for your family. If you follow along, you’ll see it’s not as hard as you think. I based this sample budget, pictured here, on a template found at

Step 1 – Setting Up the Framework and Tracking Your Money

Set up the framework of your budget on a spreadsheet.

Use an Excel spreadsheet or a Google Spreadsheet. They are very similar.

Label your rows and columns and learn how to add formulas to your cells. Learn to calculate totals and differences. It’s fairly easy.

We will start by naming ROWS.

First divide your spreadsheet into 3 sections. The first section will be labeled ‘INCOME’. The ROWS in this section are named as follows:

Salary 1

Salary 2

Investment income

Other

After this will be a mini section labeled ‘Totals’

The second section will be labeled ‘EXPENSES’. Include several category ROWS and list individual item rows under each category. For example, under the category ‘House & Utilities’ you would list as rows ‘Mortgage/Rent’, ‘Power’, ‘Water’, etc. The category rows in this section are named as follows:

House/Utilities – list individual expenses

Transportation – list individual expenses

Insurance – list individual expenses

Savings/Loan Payments/Investments – list individual expenses

Variable Expenses – list individual expenses

After this will be a mini section labeled ‘Totals’

The third main section on your spreadsheet will be labeled ‘Summary’. These are the ROWS in this section:

Budgeted Income:

Budgeted Expenses:

Actual Income:

Actual Expenses:

Now let’s turn to the COLUMNS. The column headings will be named as follows and will encompass the first 2 sections:

Budgeted

Actual

Difference

Comments

In the third section labeled Summary, here are the column headings:

Totals

Difference

The columns in this third section will be used to contain dollar amounts. So, to the right of the line named Budgeted Income, that cell will contain the totaled budgeted income from the first section.

To the right of the line named Budgeted Expenses, that cell will contain the totaled budgeted expenses from the second section.

To the right of the line named Actual Income, that cell will contain the totaled actual income from the first section.

To the right of the line named Actual Expenses, that cell will contain the totaled actual expenses from the second section.

Under the column heading ‘Difference’, those cells will contain the dollar amount difference between the totals:

Budgeted Income minus Budgeted Expenses

Actual Expenses minus Actual Expenses

Learn how to total your columns. Also learn how to calculate the differences in the third section. Once you have the formulas set up you will be able to make changes in any cell and have it reflected in all your totals and your summary.

Once you have your spreadsheet ready, we are going to suggest that you set it aside for a bit and use a pen and notebook to begin tracking your money. Eventually, you can insert your numbers to your spreadsheet every day or so in the evening. Remember to keep a receipt when you spend any money.

In this step you will determine how you spend your money now. You will just keep track of what you’re spending. You also need to keep track of how much money is coming in. To do this, you’ll need to be as specific as possible so that you can get a true idea of your finances.

This is going to take cooperation between all the family members.

The simplest way to keep track is to get a spiral notebook and a large bowl or basket.

Also, try to start this process on the first day of the month.

Income:

Know how much money you have coming in. Understanding what you have to work with is essential to creating realistic expectations for your spending allocations.

The point is to end up with a fairly accurate income figure for the end of the month.

Write down what you earned last month as a starting point for your budget. For many, this is unlikely to change.

In most households, paychecks come at regular intervals for example you may get paid once a week.

However, there are professions where money comes in sporadically and even daily. Just make sure you note all the income you receive during the month.

If your budget does vary month to month, you can take an average of the last three months if possible, or you can estimate what you think it is likely to be this month based on past information.

Important: keep a paper record for any money you receive as income.

Expenses:

Now track your expenses by writing each on a line. Take an average for the ones that fluctuate. If you’d like, you can organize your expenses by category such as transportation, utilities, household, food and entertainment, and credit card payments.

Write Down Every Penny

During this first month, you need to write down every penny that you spend.

For example, it’s not enough to write down that you spent $53.45 at the grocery store. You need to hang on to that receipt so that you know what you bought at the store. This will be important later when you’re looking at where you can trim your expense.

So write down any money you spend. This includes purchases made on credit cards and debit cards as well as cash. If you spend one penny, it needs to be written down in the notebook.

You might want to keep a smaller notebook in your purse or car to help you keep track of spending when you’re on the go. Then come home and record it in the main spiral that the entire family is using.

Collect Your Receipts

Place a bowl in the middle of your dining room table or some other prominent place so that family members can drop receipts into it when they spend family money.

Remember, for every purchase you make, you need to ask for a receipt. Place all of the receipts in the bowl so that you can have them to reference later. This might be difficult to remember, but it’s really the most critical step. Also remember to write down each expense in your notebook.

By the end of the month, this will come more naturally. And you’ll need to continue this habit for a while so that you can get control over what you’re spending and be aware.

Finally, after one month, put the receipts into a large envelope labeled with the month and year. Next you’ll subtract the total of your expenses from your monthly income. If you end up with a negative number or are concerned that you’re cutting it close, you can review your expenditures to try to find ways to cut costs.

At some point start adding your income and expenses right to your spreadsheet and calculate the totals as you go along.

Awareness is crucial to managing your money.

Believe it or not, most people have no idea how much money they really have coming in and how much is going out. You can’t have a realistic financial life if you don’t know what’s happening with your money.

Keep it simple at first while you get the hang of this new budget. You can make changes or enhancements to this basic system over time. You’ll soon discover the great results of keeping a budget; you will be glad you took the time to invest in this positive habit.

Step 2: A Critical Look at Your Finances

You’ve been tracking your spending for a month. Now it’s time to examine it closely. This can take a few hours, so make sure you set aside a good amount of time to do this.

If you have a spouse, this process is best done together.

First you need to go through your income and total up what you brought in. This is a number that you need to pay close attention to. You’ll want to make sure that from now on you stay within this number with your expenditures.

Next, you need to begin categorizing the money that’s going out. There are several categories that expenses generally fall into. For example:

Housing

Saving

Utilities

Insurance

Donations

Debt Payments

Transportation

Clothing

Expenses for school

Expenses for work

Medical expenses (prescriptions, insurance, co-payments, etc)

Food – groceries

Food – eating out (this includes those trips to the coffee shop)

Entertainment

Other – depending on your family there could be some extra categories

Getting your spending divided into categories will help you to make decisions about necessary expenses versus those that can be cut out. Now that you have the big picture, it’s time to make some tough decisions.

Step 3: Trim the Fat or Increase Income

Looking at your budget, it’s possible that your expenses outweigh your income.

This is especially true if you have a lot of debt payments. You’ll need to either trim expenses or bring in more money. Which you choose will depend a lot upon your expenses.

Now it’s time to make the hard choices. You’ll need to get out those receipts now. Go through every item that you’ve purchased and decide what purchases you needed and what purchases were really luxury items.

It can be hard to be honest about your expenses, but it’s time to really take hard look at it and make sure you’re being realistic about needs versus wants. Take a look at some examples of things you could probably trim:

Fast food

Eating out

Salon services – hair, manicures, pedicures, etc.

Expensive café drinks

Magazines

Entertainment- movies, shows, etc.

Clothing purchases

Travel

This doesn’t mean that you have to throw out the baby with the bathwater. You don’t have to eliminate every single luxury item. However, if you’re spending more money than you make or charging items on credit cards, you need to trim those expenses.

For example, if you go out to eat several times a week, try to eliminate one of those trips. Or limit yourself to eating out once a week. If you get your nails done every week, try alternating weeks.

If you try to eliminate all the luxuries from your life, you may find that you end up going on a spending binge later. Instead, try to be realistic about what you can live with if you have some wiggle room in your budget.

There are a few things you need to think about when you’re trying to reconcile your income versus expenses. Here’s how to know if you need to make changes of if you’re doing okay. Most people have an area where they can improve.

If You Have to Charge It, You Can’t Afford It

Your first goal should be to stop charging on credit cards. If you can’t afford something, you need to try to eliminate that expense from your life. This may not happen overnight, but over time you need to get those expenses organized and under control.

Credit cards can really be a trap. You see something you want, but you don’t have money in the bank to buy it. So you reach for that little card that has some room on it and have the instant gratification that you crave.

It feels great – until the bill arrives in the mail or your inbox. And while it seemed like a good idea at the time, credit card debt is one of the worst things that can happen to your finances.

Unless you pay off your balance each month, you’re going to be paying a lot more than retail for the items you charge.

It’s easy to justify credit card debt, but try not to.

Remember that if you can’t afford an item with cash or what’s in your bank account, you can’t afford it period. Resist the urge to charge items

Instead of increasing your debt, you need to be working to get beyond paying the minimum payments on your credit cards. Paying only the minimums can keep you in debt forever – and the interest will often be more than the original purchase.

Ability to Save

Even if your expenses don’t outweigh your income, you need to look at how much you’re able to put into savings. You should be saving at least ten percent of your income and if you can’t do that, it’s time to trim expenses.

If you’re already saving that amount, you might want to increase the percentage.

The more money you have to save and invest, the more secure you’ll feel now and in the future. As you’re looking at where to trim expenses focus on putting more in savings.

Still Stretched Too Thin

It’s possible that you’re cutting all the extras and still can’t make ends meet. This is especially true if you’ve recently undergone a major life change such as a layoff or divorce.

Understandably, you may be feeling desperate at this point.

If this is happening in our life, you may have to take on a second job to increase your income.

You may also want to consider finding a way to get some extra education and training to help you increase your future income.

Here are a few other ways you might be able to make your dollars stretch further or bring in more income:

Get a roommate or rent out a room in your home.

Take a second job

Look for financial aid for training

Talk with family members about temporary help

Save on groceries by using coupons and shopping sales

Take advantage of yard sales and thrift stores for needed items

Sell items you own that may have value

Downsize your living situation

Think about your talents and skills and decide if you can charge for them – for example sewing and mending clothes, art, photography, handyman services, computer repair, yardwork, and cleaning.

It’s important to remember that, while the economy is bad right now it won’t last forever.

Making sacrifices now will allow you to have a greater ability to manage your finances when things start to improve.

Step 4: Realize What You Should be Spending

When it comes down to it, you may not know what you should be spending on items. It’s hard to make a realistic budget if you don’t have a good knowledge of how your money ought to be distributed ideally. Here’s a breakdown of where your money should go:

Savings 10%

Housing 30%

Transportation 15%

Food 15%

Debt Payments 10%

Other 20%

These are maximums. So if you spend less than 30% on housing, you can take that extra percentage and put it toward debt payments or increase your savings. Look at the percentages of where you spend your money. Do they match up? If not, it’s time to reallocate your funds.

Make a plan using your income and expenses to make things match up a little more closely to this distribution. Make a chart of how much should be spent each month in each category.

You should post this prominently in your home and refer to it when you work on your budget spreadsheet.

You’ll also want to post how much debt you have and make a plan to pay it off as soon as possible. In the next section you’ll read ideas about how you can do that.

Step 5: Make a Plan to Pay Your Debt

If you don’t have debt, you can skip this section. However, most readers are going to find that this is an important part of the plan. If you have credit card debt, student loans, car payments, or any other type of loan payment it’s time to chip away at the debt and become free. This doesn’t include you mortgage- although it’s a good idea to put more and more money toward it to pay it off early.

Here’s how to work on your credit card debt: Get out all of your credit card bills and look at your payments. Put them in order of smallest total balance to largest balance.

Then look at the minimum payments for each. Rather than trying to pay more than the minimum on each card, focus on paying them off one at a time.

Start with the one that has the smallest balance. For all the other cards only pay the minimum payment (and stop using them!). Then, for the card that has the smallest balance take any extra income you can and put it toward that card until it’s paid off.

Once that one’s paid off, move on to the next lowest balance. When that one is paid off, go on to the next one. Continue doing this until they’re all paid off. It may seem like a process that’s difficult and never ending, but once you pay off that first card you’ll feel a little extra motivation.

Step 6: Continue to Track Spending

You know what you have coming in, going out, and you have a plan to pay off debt. Now you

need to continue to track your spending. This will help you to stay accountable for sticking with

your plan.

Many people make a budget, but then stop paying as close attention to spending and earnings.

To have success, you’ll need to continue writing down every penny so that you don’t get out of control with your spending.

Writing down your purchases will help you to be more mindful of them. It will give you a moment to think about whether or not a purchase is totally necessary or if it’s within your budget plan.

Step 7: Plan for Your Future

It’s hard to plan for your future until you’re out of debt. Once your credit cards and some of your other debts are paid off, you need to focus you efforts on saving for the future.

At this point you’ll want to increase the amount of money you’re putting into savings and begin to think about investing in your retirement and education funds for your children.

For this step you’ll want to contact a financial planner.

A financial planner can help you determine what investments are good for you and your family.

Don’t just go with the first person you meet. Meet with a few financial planners to compare what they offer for you. With information in hand you can choose one that seems the best for you.

Step 8: Keep Working On Your Budget

Continue to keep tabs on your finances using the process described above. If you slack off you are almost sure to lose your footing with your money. Budgeting is a practice and a habit that serves you and your family well. So be consistent. No matter how much money you have, managing your finances is vital.

You have a basic budget spreadsheet now, and this is a great way to start; it’s not too complicated and may be all you will ever need. Good luck and enjoy budgeting!